retroactive capital gains tax meaning

As part of the proposal the Biden administration would raise capital gains for individuals earning more than 1 million from their marginal tax rate 37 percent to. Analyze Portfolios For Upcoming Capital Gain Estimates.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

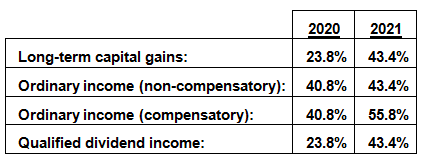

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates.

. The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate. That would mean 48000 taxpayers would not pay 205 million in retroactive taxes for capital gains in the first four months of 2002 and 157000 people and businesses who paid.

Published Oct 21 2021. Retroactive capital gains tax meaning Friday March 18 2022 Edit. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. The purpose of the 709 is to apply the gift to your lifetime exemption. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

A quick recap. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. With the new tax hikes proposal developed in Washington recently there are notable changes coming to your capital gains and dividend.

The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. The Presidential Administration made a huge splash earlier. Capital Gains Tax.

This would undo the capital gains increase but it could also create fertile ground for lawsuits by. While some Democrats have expressed concern about a capital gains increas See more. Failing to file the 709 makes the gift taxable.

With a retroactive capital gains tax looming what could this dramatic shift in taxation mean for nonprofit fundraising. A Retroactive Capital Gains Tax Increase. And remember that the capital gains hike isnt the only tax increase proposed for the near future.

As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when. Biden plans to increase this. The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income.

McNair Dallas Law. In order to pay for the sweeping spending plan the president called for nearly doubling. So in 2016 you had told me you and your team or up all night you were trading the.

I mean I think thats the thing that would really crush the market and be a be a major concern. Baucus has pledged to try to restore the estate tax retroactively in 2010. Filing late imposes a penalty not the tax of 5 up to 25 of.

The capital gain hikes. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have. Otherswhich will likely not be introduced retroactively but instead for 2022 and.

If the sale were to occur in 2022 at a 396 long-term capital gain. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike.

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

Tax Proposals Under The Build Back Better Act Version 2 0

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How The Wealthy Are Preparing For Higher Taxes

What If Biden S Capital Gains Tax Is Retroactive Morningstar

Tax Changes For 2022 Kiplinger

Advisers Blast Biden S Retroactive Capital Gains Proposal

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Tax Cuts Jobs Act Tcja H R Block

State Income Tax Rates And Brackets 2022 Tax Foundation

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

Why Sellers To An Esop May Benefit By Pre Paying Their Capital Gains Taxes In 2021

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)